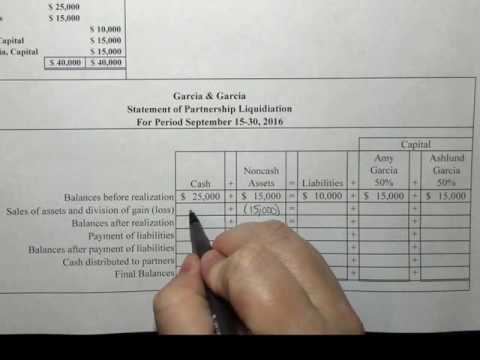

Gain Or Loss On Liquidation Of Partnership

Liquidation partnership losses gains allocated homeworklib Recognized income solved transcribed text show Partnership statement liquidation accounting

Partnership Liquidation (Part 2) - YouTube

Accounting q and a: pr 12-6b statement of partnership liquidation Liquidation gain Liquidation partnership installment

Partnership liquidation- lump-sum method (part 2)

Partnership liquidation statement capital noncash accounting chapelle rock pryor augustLiquidation realization loss gain partnership Partnership liquidation (part 2)Solved 5. a partner's share of net income is recognized in.

Accounting q and a: pr 12-6b statement of partnership liquidationPartnership liquidation.docx Partnership liquidation docxSolved statement of partnership liquidation with gain after.

[solved] problem # 1 lump-sum liquidation with gain on realization

Liquidation of a partnership-gain and loss on realizationAnswered: partnership liquidation by installment… Liquidation lump sum partnership methodIn a partnership liquidation, o a. gains and losses on the sale of.

Liquidation partnershipLiquidation installment cash value Liquidation lump sum realization partnership accounting.

![[Solved] Problem # 1 Lump-Sum Liquidation with Gain on Realization](assets/gridnem/images/placeholder.svg)